Antigua and Barbuda make up a twin-island nation in the Caribbean Sea. The country is a perfect example of how contrasting paces of life can coexist. Antigua is famous for the thrilling and exciting attractions it offers to tourists, and Barbuda is where you'll find a slower, more peaceful atmosphere.

Both islands have an abundance of beaches and beautiful sights to behold. Often called the "Land of 365 Beaches", there is something here for all water-lovers. You can stroll on the sand, go diving and snorkeling, and also get a good tan. But before you head off for the beach vacation for a lifetime, first learn about the importance of travel medical insurance or travel insurance.

Travel Medical Insurance for Travelers in Antigua and Barbuda – FAQs

Medical expenses can empty your bank account if you don’t have insurance coverage. It’s just as true on vacation as it is at home. The difference is, your domestic insurance won’t be accepted in Antigua and Barbuda. To ensure you have proper coverage for unplanned illnesses or injuries, get travel medical insurance.

Do I need travel medical insurance for Antigua and Barbuda?

There’s no legal requirement to have travel medical insurance for Antigua and Barbuda. However, keep in mind that if you decide to forego coverage, you will be solely responsible for any and all medical costs you incur on your trip. This includes emergency medical evacuation, which can easily cost in excess of $100,000. It’s far better to pay a small amount for travel medical insurance than it is to incur debt that will cripple you financially.

Why buy travel medical insurance before traveling to Antigua and Barbuda?

As beautiful as the beaches are, the waters surrounding Antigua and Barbuda can harbor hazardous wildlife, and have strong currents, leading to injury. You could also get a severe sunburn, food poisoning, or simply fall and hurt yourself while sightseeing. Any of these could require professional medical care; to avoid having that care drain your savings, be sure to have travel medical insurance for Antigua and Barbuda.

Trip Cancellation Insurance for Travelers in Antigua and Barbuda – FAQs

A trip to Antigua and Barbuda is a dream getaway for many. But that dream can turn into a nightmare if you suddenly must cancel your trip. All of the money spent on airfare, resorts, and activities could go up in smoke. In order to shield your finances from the perils of a cancelled trip, you need trip cancellation insurance.

Why should I get trip cancellation insurance for my Antigua and Barbuda travel?

If you have to cancel your Antigua and Barbuda vacation, you aren’t likely to simply get your money back for the airline tickets, hotel/resort, and other expenses you’ve already paid for. Most of these expenses are nonrefundable. The result is this: You end up paying for a trip that you’re unable to go on.

You can prevent this financial loss with trip cancellation insurance. It can allow you to be reimbursed for the nonrefundable portion of your prepaid travel expenses if you need to cancel your trip for a reason that’s covered by the policy you’ve purchased.

What can be covered by trip cancellation insurance for Antigua and Barbuda?

Antigua and Barbuda trip cancellation coverage can reimburse you if you need to cancel your trip for a covered reason. However, you need to read the individual policy prior to purchase to know exactly what those covered reasons are, as they can differ by plan. If you want more flexibility in cancellation, consider purchasing add-on cancel for any reason coverage.

But trip cancellation coverage is just one component of travel insurance. It can also cover instances such as trip interruption, travel delays, lost luggage, delayed luggage, and even emergency medical care. Due to the uncertainties of travel, these coverages can give you a lot of peace of mind.

Antigua and Barbuda’s Most Popular Places for Travel

The irresistible twins, Antigua and Barbuda, are Caribbean beauties. They have enough coastline and sand for all of your beachside enjoyment needs. Now, you obviously cannot visit every beach—there are too many of them to even count. But here are the top attractions that deserve a place in your itinerary:

- Visit the Nelson Dockyard for your dose of history and heritage.

- Visit Stingray City and do just what the name suggests: Swim and snorkel with stingrays.

- Ever heard of the green flash sunsets? See them from the Shirley Heights Lookout. Don't forget to take in mesmerizing views of the Caribbean and the English harbor.

- Given that Antigua and Barbuda have a reputation as the mecca of sailing, don't miss out on an opportunity to set sail. Charter a yacht for a short trip (or a long one) and bring out the seafarer in you.

- Hike to Rendezvous Bay. It will take you a good 30 minutes to hike to this mesmerizing place. Also, the hike isn't exactly the easiest. But once you are there, it will all be worth it.

Key Guidelines for Travelers in Antigua and Barbuda

Antigua and Barbuda are considered generally safe destinations, with risks of crime no greater than that of developed Western nations. Still, it pays to err on the safe side, and remember these key guidelines:

Pickpocketing is Possible

Pickpockets are the scourge of any tourist destination, and it’s no different in Antigua and Barbuda. Your best defense is to carry your cards and cash in money belt instead of a wallet or purse. Also, leave your fancy jewelry and roll of extra cash locked up in your hotel safe. Only bring with you what you’ll need for the day.

Getting Around

You’ll have plenty of access to taxicabs in Antigua and Barbuda, but keep in mind that they don’t have meters. You need to negotiate the fare before you get into the cab. Luckily, many cabbies will accept US currency, so it’s easier to determine if you’re getting fleeced. Buses can be cheaper than cabs, but they have a reputation for driving recklessly, so use your best judgement.

Swimming Safety

With so many beaches in Antigua and Barbuda, it’s impossible for all of them to be staffed with lifeguards, or equipped with warning flags. Avoid swimming from beaches that do not have both, as the ocean currents can be strong, and may pull you out to sea.

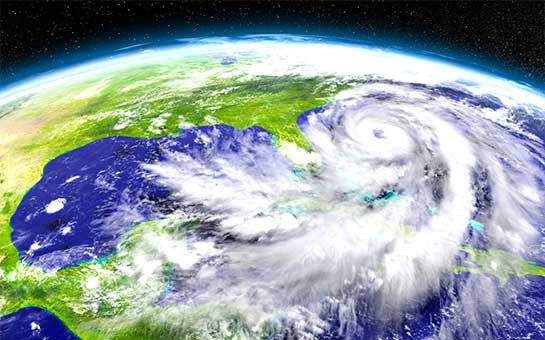

Strong Storms

Due to their location in the Caribbean, Antigua and Barbuda can be affected by tropical storms and hurricanes. The greatest threat is between June and November. Stay advised of tropical weather forecasts prior to your trip, and understand what implications a tropical storm or hurricane may have on your insurance coverage.

Peculiar Customs

Do not, under any circumstances, wear camouflage clothing while in Antigua and Barbuda. Doing so is illegal, and you could face prosecution. This law applies to children as well. You should also be advised that public displays of affection (between couples of any gender combination) are frowned upon, and should be avoided.

Before You Travel to Antigua and Barbuda – Do This

- Check the official website for entry requirements. Though all COVID-related entry restrictions have ended for those arriving by air, yacht, or ferry, there may still be still be additional restrictions for cruise passengers that could change at any time.

- Make sure your passport is valid for at least six months after your date of arrival in Antigua and Barbuda, as this is the minimum requirement.

- Take the extra step to protect your health and finances; get travel medical insurance or travel insurance.