Known locally as “Sweet Salone”, Sierra Leone is abundant with awe-inspiring scenery and welcoming residents. The warm and smiling people and the relaxed ambiance of the country make it the ideal spot for stress-relief getaways.

Also popular for a rare diamond, Sierra Leone is a land of exquisite beauty. If you’re an ocean lover, a trip to this beautiful coastline country must be on your bucket list.

Sierra Leone is abundant with wildlife. Beautiful wild creatures like hippos, elephants, chimpanzees, exotic insects, and birds are often spotted in their natural habitats. Despite its fascinating history, the country remains largely undiscovered. There’s just so much to see.

If you’re visiting Sierra Leone, you’re in for a treat. But before you leave, remember to purchase travel insurance or travel medical insurance to stay protected against unexpected accidents, illnesses, injuries, or other mishaps.

Sierra Leone Travel Medical Insurance for International Travelers – FAQs

Nothing as beautiful as the landscapes in Sierra Leone comes without a price. Yes, traveling to this exquisite destination has certain risks—but don’t let that bother you, because there is also a solution.

Travel insurance and travel medical insurance are the best choices to recover from the financial loss upon encountering the aforementioned risks. Insurance is the added safety blanket every traveler needs to enjoy and relax on your trip without worrying about medical costs.

Charges such as evacuation and repatriation are almost impossible to afford in a foreign country. Leave that burden to your travel insurance company.

Do I need Travel Medical Insurance for Sierra Leone?

Although it is not a legal requirement for travelers in Sierra Leone to possess travel insurance, it is still highly advised. A large number of both petty and violent crimes in the country put you at great risk of losing your passport, baggage, or important documents. However, travel insurance assists in reimbursing the cost of acquiring new ones.

Visitors from New Zealand are required to possess travel insurance before entering Sierra Leone due to the lack of any New Zealand political entity in the country.

Moreover, the poor sanitation and lack of security in the country increase the risk of medical issues. Such healthcare problems can often result in large, unprecedented medical bills that are hard to pay off. That is where your travel medical insurance plays a role.

Why Buy Travel Medical Insurance for Sierra Leone?

Travel medical insurance plays an extremely important role for travelers. Along with necessary medical coverage in case of an encounter with viral diseases like malaria and cholera, you also get to take advantage of benefits like medical evacuation, repatriation of mortal remains, emergency medical expenses, accidental death & dismemberment (AD&D), ID theft assistance, and natural disaster relief.

Sierra Leone Trip Cancellation Insurance for International Travelers – FAQs

Trip cancellation insurance is the safest way to protect yourself from large cancellation costs. You invest a great amount of money into trips for the purpose of bookings and travel arrangements. If some unprecedented event causes you to cancel your trip, it would result in a huge financial loss.

Trip cancellation insurance can help reimburse all your cancellation costs.

Why Buy Trip Cancellation Insurance for Sierra Leone?

Trip cancellation insurance coverage in Sierra Leone can be used for situations that occur after you have already purchased the insurance. The event must be unforeseen and unintentional. A list of valid reasons to cancel your trip and invoke trip cancellation benefits are listed in your policy’s certificate wording. Be sure to read the fine print before purchase so that you know what’s covered. Some common circumstances include:

- Death of a family member

- Injury or illness (either you or one of your travel companions)

- Terrorist attack or natural disaster in your destination

- Tourist visa denied

What all is covered under trip cancellation insurance for Sierra Leone?

Trip cancellation insurance provides coverage for a great number of prepaid, nonrefundable expenses. The exact benefits differ from plan to plan, so again, read your policy beforehand to know what you’re buying. The following costs are usually covered under trip cancellation insurance:

- Canceled flights

- Delay charges

- Loss of personal belongings such as passports, baggage

- Reimbursement for cutting your trip short

- Canceled hotel room bookings

- Emergency cash requirements

Things to Do for Travelers in Sierra Leone

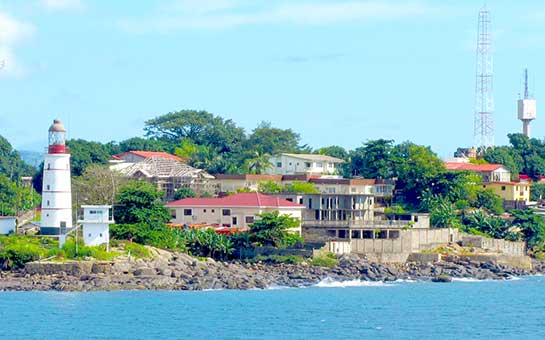

The beautiful landscapes of Sierra Leone cater to your every need. Participate in the hustle and bustle of the city of Freetown, or visit the gorgeous beaches along the coast for some peace. Try the fresh lobsters and crabs at the beach restaurants. There’s something for everyone.

- Camping out in the wild: Did you know that Sierra Leone has world-renowned chimpanzee sanctuaries? The country has numerous camping sites where you can observe hippos, elephants, and emerald starlings in their natural habitats. Lay under the stars and let the sounds of nature sing you to sleep.

- Visiting the Western Area Peninsula: Sierra Leone is home to one of the rarest ethnic groups in the world. The Krio ethnic group is composed of descendants of freed slaves from the West Indies, the United Kingdom, and Africa. These communities reside in the Western Area Peninsula. Krio architecture is a sight for sore eyes. Moreover, visitors are welcomed very warmly into the area. The village elders themselves will happily give you a tour of the Krio houses and churches.

- Hiking in the Lion Mountains: Mount Bintumani in Sierra Leone is one of the highest mountain peaks in West Africa. The striking view from the top of the cliff makes the hike worth it. A popular New Year’s tradition in the country is to picnic on the Kabala Hills. It is believed that touching the rocks brings good luck for the rest of the year. Isn’t that delightful?

- Pick up some beautiful country cloth: A unique style of weaving textiles has given rise to the “country cloth” in Sierra Leone. The beautiful rich woven cloth is a masterpiece. It serves as a great item of decor and a suitable souvenir for family and friends.

- Explore the stunning islands: The nine islands of Sierra Leone are said to have been preserved in time. They are almost completely unexplored, hence untouched by industrialization. Not many places in the world possess that quality. Upon visiting the islands, you’ll get to see sanctuaries, abandoned slave forts, and handsome tiny villages whose residents will give you elaborate tours if you ask.

Travel Risks for International Travelers in Sierra Leone

Sierra Leone used to be a travel destination for over 100,000 travelers annually. You must be aware of certain travel risks before visiting.

- Violent crime: Armed robbery, mugging, and assault are some of the more common crimes in Sierra Leone. Pick-pocketing and residential burglary are also fairly common. Avoid displays of wealth when traveling in Sierra Leone. If you are the victim of an armed robbery or mugging, do not offer any resistance, as that tends to escalate violence. Keep your car doors safely locked when traveling by road.

- Beach safety: Although Sierra Leone has the most beautiful beaches in all of Africa, you must beware of certain risks. The government has issued official warnings asking people to not walk barefoot on Lumley and other beaches. This is because needles and other pieces of dangerous trash are often discovered there. Although lifeguard services are available, they are not particularly effective. There have been instances of tourists drowning due to strong currents. Moreover, avoid walking alone on beaches after sunset altogether.

- Public demonstrations: Protests and demonstrations are common. New Zealanders in particular are advised to stay away from such gatherings, as there is no political presence of the New Zealand government in Sierra Leone. They must also always carry travel insurance.

- Health and disease: Insect-borne diseases are fairly common in Sierra Leone. You must always sleep under a bed net and apply mosquito spray frequently. Do not drink tap water, avoid uncooked or bush meat, and do not consume raw vegetables, as refrigeration is unreliable. Be aware that a yellow fever vaccination certificate is legally required in order to both enter and leave Sierra Leone.

- Local travel: You must arrange to land early in the day in order to reach your hotel before nightfall. The travel journey from the Lungi International Airport to the city of Freetown is ridden with certain security risks. You must either avoid or be extra cautious in border areas near Guinea and Liberia. The security situation there is usually unreliable, and criminal gangs are found in abundance.

Before you travel to Sierra Leone - Do These

Get a Yellow fever vaccination. You will not be permitted to enter the country without a certificate for the same, nor will you be able to board the flight back home.

Carry enough cash, as cards are rarely accepted.

Purchase adequate travel insurance considering the health and safety risks of your trip. Enter some basic traveler and trip information, consider your options, and purchase the plan that best fits your needs.