出国保险

Insubuy专业为全球游客提供出国医疗保险。无论您是团体还是个人旅行, Insubuy都可为您提供合适的保险。我们使您轻松销售美国的保险产品以提高您的市场竞争力和客户满意度。

美国旅游保险

美国境外旅游

团体旅游保险

旅程取消保险

Insubuy合作伙伴的优势

佣金

我们为合作伙伴提供高额佣金。保险公司通常给予新保险代理很低的佣金, 佣金比例会根据保险销量增加。但是您与我们合作会立即获取很高的起点。

帮助

我们理解代理出国保险不是您的核心业务; 但是我们可以为您提供完善的售前及售后服务帮助。

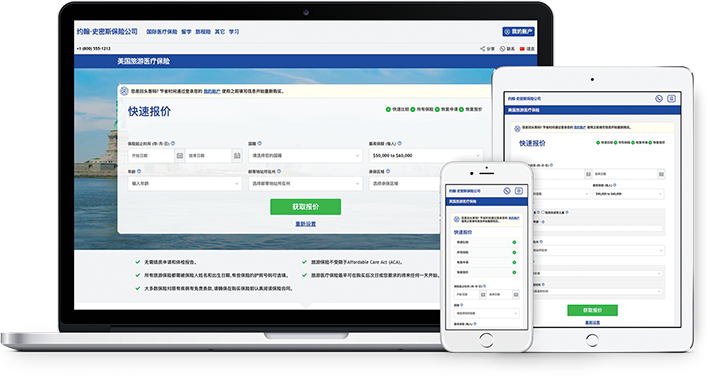

立即报价 & 购买

您可立即在线获取多款保险快速报价,全面比较和在线购买。我们还可以提供团体出国保险。